Essay

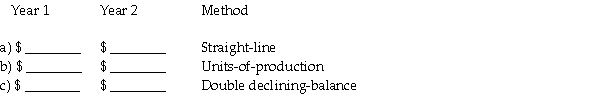

Bobson Company purchased a $60,000 machine on January 1. The machine is expected to have a useful life of 10 years or 60,000 operating hours and a residual value of $5,000. The machine was used for 6,000 hours in the first year and 4,400 hours in the second year. Compute the amount of depreciation expense for the first and second years under each of the methods below.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: According to the MACRS tax rate table,

Q9: What would the depreciation expense be in

Q10: For each of the following, identify in

Q11: The depreciation method which charges more expense

Q12: Incidental costs or assessments that should be

Q14: Equipment that originally cost $1,500 with no

Q16: A budgeted item such as a building

Q17: Ken Alberts owned equipment with an original

Q18: If there are repairs needed in the

Q50: The double-declining-balance method is an accelerated depreciation