Multiple Choice

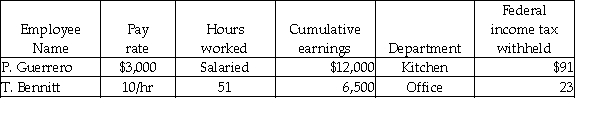

Gail's Bakery had the following information before the pay period ending June 30:

Assume: Each hourly employee is paid 1½ times pay rate for time worked in excess of 40 hours.

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Office Employee Wage Expense?

A) Debit $565

B) Credit $565

C) Debit $510

D) Credit $510

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Employees must receive W-3s by January 31

Q10: A banking day is any day that

Q11: FICA taxes are levied only on employees.

Q12: The correct journal entry to record the

Q13: Form 940 is used by businesses that

Q15: Information to prepare W-2 forms can be

Q17: The balance in the Wages and Salaries

Q18: The following data applies to the July

Q19: For each of the following, identify in

Q37: The following data applies to the July