Multiple Choice

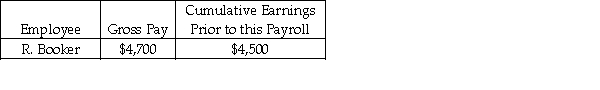

Jefferson Tutoring had the following payroll information on February 28:  Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 2% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Using the information above, the journal entry to record the payroll tax expense for Jefferson Tutoring would include:

A) a debit to Payroll Tax Expense in the amount of $429.55.

B) a credit to FUTA Payable for $20.00.

C) a credit to SUTA Payable for $50.00.

D) All of the above are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: The following data applies to the July

Q19: For each of the following, identify in

Q20: Prepare the general journal entry to record

Q21: Wages and Salaries Expense is:<br>A) equal to

Q22: Using the information below, determine the amount

Q25: There is no limit on the amount

Q26: Both employer and employee contribute to FICA-OASDI

Q27: The W-3 is also known as the

Q28: Ben's Mentoring had the following information for

Q111: The following data applies to the July