Multiple Choice

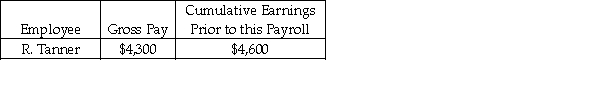

Mid-West Tutoring had the following payroll information on January 31:  Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

Assume: FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State Unemployment tax rate is 2% on the first $7,000.

Federal Unemployment tax rate is 0.8% on the first $7,000.

Federal Income Tax Withheld $900; State Income Tax Withheld $300.

Using the information above, the journal entry to record the employee's payroll expense would include:

A) a debit to Payroll Tax Expense in the amount of $4,300.

B) a debit to Wages and Salaries Expense in the amount of $4,300.

C) a credit to Cash in the amount of $4,300.

D) a credit to FUTA Payable for $120.

Correct Answer:

Verified

Correct Answer:

Verified

Q72: FIT Payable has a credit normal balance.

Q73: For each of the following, identify in

Q75: The account for Payroll Tax Expense includes

Q76: Prepare the general journal entry to record

Q78: Ben's Mentoring had the following information for

Q79: Cash - Payroll Checking is a(n):<br>A) contra-asset.<br>B)

Q80: The following data applies to the July

Q81: A company must pay Form 941 taxes

Q82: Which taxes are considered 941 taxes?<br>A) FICA,

Q89: The following data applies to the July