Essay

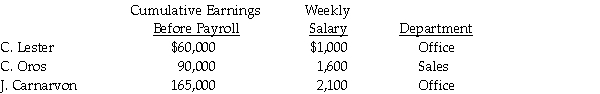

Prepare a general journal payroll entry for Advanced Computer Programming using the following information:  Assume the following:

Assume the following:

a) FICA: OASDI, 6.2% on a limit of $128,400; Medicare, 1.45%.

b) Federal income tax is 15% of gross pay.

c) Each employee pays $20 per week for medical insurance.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q25: There is no limit on the amount

Q26: Both employer and employee contribute to FICA-OASDI

Q27: The W-3 is also known as the

Q28: Ben's Mentoring had the following information for

Q30: For each of the following, identify in

Q31: What type of an account is Wages

Q32: Which form is used to report FICA

Q33: The following data applies to the July

Q34: The form used for the annual federal

Q111: The following data applies to the July