Short Answer

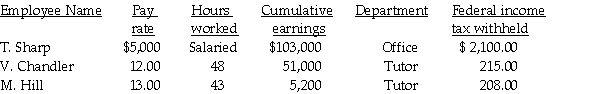

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total deductions.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: The following data applies to the July

Q62: Ben's Mentoring had the following information for

Q64: The look-back period is used to determine

Q65: Form 941 taxes include OASDI, Medicare, and

Q66: The following data applies to the July

Q68: Ben's Mentoring had the following information for

Q69: When a business starts, what must it

Q70: The entry to record employer's total FICA,

Q71: The payment of FUTA would include:<br>A) a

Q72: FIT Payable has a credit normal balance.