Essay

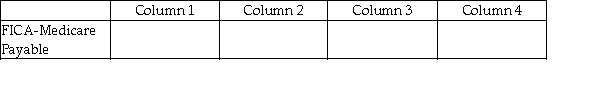

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

-

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Form 941 is filed:<br>A) monthly.<br>B) annually.<br>C) weekly.<br>D)

Q2: FUTA taxes are paid:<br>A) by the end

Q4: The correct journal entry to record the

Q5: Prepare the general journal entry to record

Q6: What is debited if State Unemployment Tax

Q7: S. Paul, an employee of Plum Hollow

Q8: For each of the following, identify in

Q9: Employees must receive W-3s by January 31

Q10: A banking day is any day that

Q11: FICA taxes are levied only on employees.