Essay

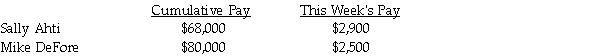

Compute the net pay for each employee. The FICA tax rate is: OASDI 6.2% on a limit of $128,400; Medicare is 1.45%; federal income tax is 15%; state income tax is 5%; and medical insurance is $100 per employee.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q23: Workers' compensation insurance is deducted from employees'

Q24: Most employers are levied a payroll tax

Q25: As the Prepaid Workers' Compensation is recognized,

Q26: A summary record of each person's earnings,

Q27: If the employee has $700 withheld from

Q29: An allowance or exemption represents a certain

Q30: Both employees and employers pay which of

Q31: An employee has gross earnings of $1,800

Q32: Given the following payroll items you are

Q33: To compute federal income tax to be