Multiple Choice

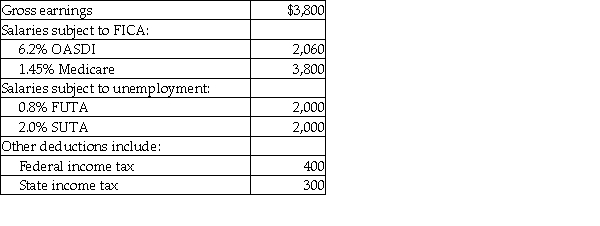

Bob's Auction House's payroll for April includes the following data:  What is the employer's portion of the taxes? (Round intermediary calculations to the nearest cent and final answers to the whole dollar.)

What is the employer's portion of the taxes? (Round intermediary calculations to the nearest cent and final answers to the whole dollar.)

A) $183

B) $184

C) $239

D) $700

Correct Answer:

Verified

Correct Answer:

Verified

Q126: Prepaid Workers' Compensation Insurance is what type

Q127: Workers' Compensation Insurance is:<br>A) paid by the

Q128: Unemployment taxes are:<br>A) based on wages paid

Q129: Premiums for workers' compensation insurance may be

Q130: The taxable earnings column of the payroll

Q132: The amount of federal income tax withheld

Q133: The Federal Insurance Contributions Act is better

Q134: Gross Earnings are the same as:<br>A) regular

Q135: A calendar quarter consists of:<br>A) 13 weeks.<br>B)

Q136: An employer can reduce the federal unemployment