Essay

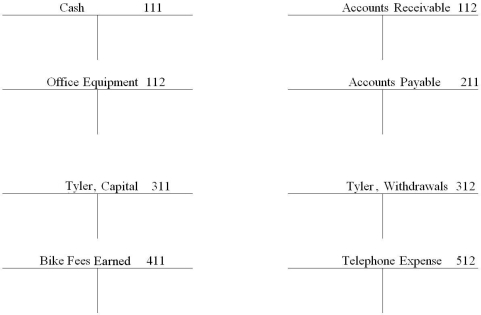

The following transactions occurred during June for Center City Cycle Shop. Record the transactions below in the T accounts. Place the letter of the transaction next to the entry. Foot and calculate the ending balances of the T accounts where appropriate.

a. invested $6500 in the bike service from his personal savings account.

b. Bought office equipment for cash, $900.

c. Performed bike service for a customer on account, $1,000.

d. Company cell phone bill received, but not paid, $80.

e. Collected $500 from customer in transaction c.

f. withdrew $300 for personal use.

Correct Answer:

Verified

Correct Answer:

Verified

Q77: Double-entry accounting requires transactions to affect two

Q78: Cash is credited when the business makes

Q79: Which of the following types of accounts

Q80: Accounts Payable indicates monies owed to us

Q81: Equipment is an example of a Capital

Q83: Net income or net loss for a

Q84: For each of the following, identify in

Q85: Determine the beginning owner's equity of a

Q86: The entry to record Tom's payment of

Q87: The following is a list of accounts