Multiple Choice

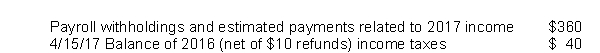

During 2017, a state has the following cash collections related to state income taxes  1/15/18 payroll withholdings and estimated payments related to 2017 income $ 30

1/15/18 payroll withholdings and estimated payments related to 2017 income $ 30

2/15/18 payroll withholdings and estimated payments related to 2017 income $ 35

3/15/18 payroll withholdings and estimated payments related to 2017 income $ 25

4/15/18 Balance of 2017 (net of $5 refunds) income taxes $ 45

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2017 government-wide financial statements related to state income taxes?

A) $400.

B) $475.

C) $430.

D) $465.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Which of the following are derived tax

Q34: Payments made to a state pension plan

Q35: A city levies a 2 percent sales

Q36: A government is the recipient of a

Q37: A city levies a 2 percent sales

Q39: A city is the recipient of a

Q40: State governments should recognize food stamp revenue<br>A)

Q41: A city levies a 2 percent sales

Q42: A city that has property taxes of

Q43: Unrestricted grant revenues with a time requirement