Short Answer

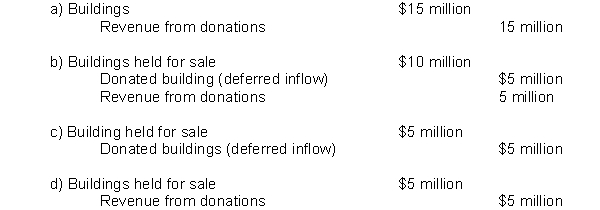

A wealthy philanthropist donates three buildings to H-Town. Each building has a fair market value of $5 million. The town plans to use Building 1 as a new fire station and sell Buildings 2 and 3. Building 2 is sold after year-end, but within the availability period. Building 3 fails to sell by the time the town issues the financial statements. Which of the following correctly records revenue from these donations in the governmental fund financial statements?

Correct Answer:

Verified

Correct Answer:

Verified

Q58: Answer the following questions with regard to

Q59: In accounting for property taxes, under the

Q60: During 2017, a state has the following

Q61: The modified accrual basis of accounting is

Q62: Income taxes are classified as ad valorem

Q64: Governments use modified accrual accounting to determine

Q65: Taxes that are imposed on the reporting

Q66: A city with a 12/31 fiscal year-end

Q67: As used in defining the modified accrual

Q68: Reimbursement-type grant revenues are recognized in the