Essay

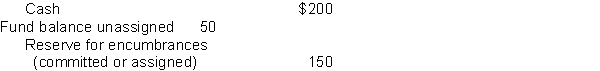

Assume that the County of Katerah maintains its books and records in a manner that facilitates preparation of the fund financial statements. The county formally integrates the budget into the accounting system and uses the encumbrance system. All appropriations lapse at year-end. At the beginning of the fiscal year, the county had the following balances in its accounts. All amounts are in thousands.

REQUIRED: Prepare the necessary entries for the current fiscal year.  (a) The county made the appropriate entry to restore the prior-year purchase commitments.

(a) The county made the appropriate entry to restore the prior-year purchase commitments.

(b) The county board approved a budget with revenues estimated to be $800 and expenditures of $750.

(c) The county received the items that had been ordered in the prior year at an actual cost of $135.

(d) The county ordered supplies at an estimated cost of $50 and equipment at an estimated cost of $70.

(e) The county incurred salaries and other operating expenses during the year totaling $600. The county paid these items in cash.

(f) The county received the equipment at an actual cost of $75.

(g) The county earned and collected, in cash, revenues of $810.

Correct Answer:

Verified

Correct Answer:

Verified

Q55: A public school district formally adopted a

Q56: At year-end Oakland County had $3,000 of

Q57: For most governments, the "variance" column on

Q58: GASB requires that government entities present their

Q59: Which of the following is a primary

Q61: The town of Terry began 2016 with

Q62: Not-for-profit budgets can rely on levies in

Q63: School District #25 formally integrates the budget

Q64: GASB, but not FASB, sets standards for

Q65: When budgets are integrated into a government's