Essay

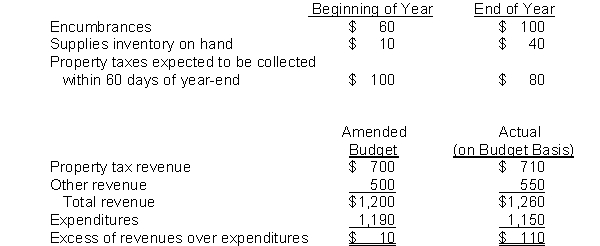

Kayla County prepares its general fund financial reports in accordance with generally accepted accounting principles (GAAP) but its budgetary basis for the general fund differs from GAAP. The budget-to-actual comparison for the general fund is presented below. All numbers are in thousands.

REQUIRED: Prepare the GAAP-basis operating statement for the general fund.

(a) For budgetary purposes, the county recognizes encumbrances as expenditures in the year of the purchase commitment; it recognizes supplies as expenditures when acquired. For budgetary purposes the county recognizes all revenues in the fiscal year collected.

For GAAP-basis financial reporting, the county recognizes supplies as expenditures as consumed. It recognizes property taxes as revenue if they are collected within 60 days of fiscal year-end. All other revenues are recognized on the cash basis for GAAP.

(b) The following additional information is available.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: A review of Park City's books shows

Q27: State and local governments must prepare their

Q28: Which of the following is NOT a

Q29: Lincoln County uses encumbrance accounting to control

Q30: To close Encumbrances at the end of

Q32: Capital budgets focus on plans for the

Q33: Why would a government be more likely

Q34: Why may flexible budgets be more appropriate

Q35: A governmental entity has formally integrated the

Q36: Character, in relation to expenditures, represents<br>A) The