Multiple Choice

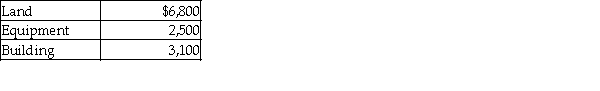

Hastings Corporation has purchased a group of assets for $21,900. The assets and their relative market values are listed below.  Which of the following amounts would be debited to the Land account? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

Which of the following amounts would be debited to the Land account? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) $4,133

B) $12,045

C) $4,380

D) $5,475

Correct Answer:

Verified

Correct Answer:

Verified

Q2: For each of the following amounts paid

Q3: For each of the following expenditures, indicate

Q9: A trademark should not be amortized over

Q19: A business,which has a calendar year accounting

Q43: Regardless of the type of plant asset

Q63: Amortization is the process by which businesses

Q66: Blake,Inc.purchased a van on January 1,2015,for $800,000.Estimated

Q131: Capitalizing a cost involves crediting the asset

Q189: U.S.Generally Accepted Accounting Principles permits the presentation

Q191: Estimated residual value can be zero if