Multiple Choice

A company receives payment from one of its customers on August 5 for services performed on July 21. Which of the following entries would be recorded if the company uses accrual basis accounting?

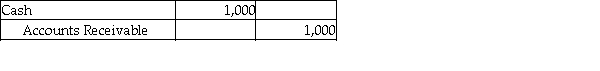

A)

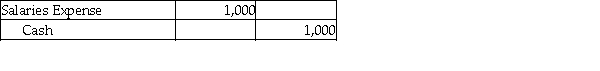

B)

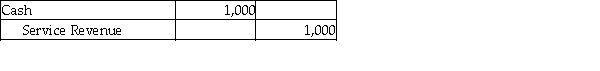

C)

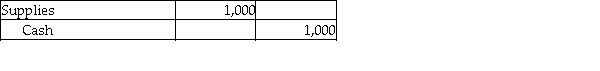

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q27: A depreciable asset's cost minus accumulated depreciation

Q28: Explore,a travel magazine,collected $500,000 in subscription revenue

Q29: Healthy Living,a diet magazine,collected $240,000 in subscription

Q38: Which of the following assumes that financial

Q49: What is the term used for the

Q61: The sum of all the depreciation expenses

Q64: On December 31, 2016, interest of $1,500

Q122: Luminous Electrical performed services of $8,000 on

Q157: Hank's Tax Planning Service started business in

Q162: The goal of the time period concept