Essay

The accounting records of Marcus Service Company include the following selected, unadjusted balances at June 30: Accounts Receivable, $2,700; Office Supplies, $1,800; Prepaid Rent, $3,600; Equipment, $15,000; Accumulated Depreciation - Equipment, $1,800; Salaries Payable, $0; Unearned Revenue, $2,400; Office Supplies Expense, $2,800; Rent Expense, $0; Salaries Expense, $15,000; Service Revenue, $40,500.

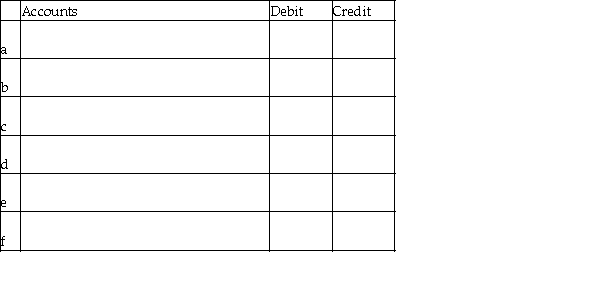

The following data developed for adjusting entries are as follows:

a. Service revenue accrued, $1,400

b. Unearned Revenue that has been earned, $800

c. Office Supplies on hand, $700

d. Salaries owed to employees, $1,800

e. One month of prepaid rent has expired, $1,200

f. Depreciation on equipment, $1,500

Journalize the adjusting entries. Omit explanations.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: The revenue recognition principle guides accountants in

Q20: An adjusting entry is completed _.<br>A)at the

Q37: On September 1,2016,Joy Company paid $6,000 in

Q58: The depreciation method that allocates an equal

Q71: Wentlent Services Company records deferred expenses as

Q71: Accrued revenue represents the receipt of cash

Q108: Williams Enterprises prepaid six months of office

Q125: Under cash basis accounting,revenue is recorded when

Q161: Which of the following accounts would be

Q212: In the case of deferred revenue,the adjusting