Essay

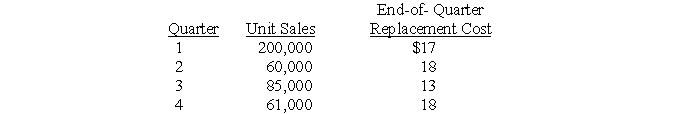

Blink Company, which uses the FIFO inventory method, had 508,000 units in inventory at the beginning of the year at a FIFO cost per unit of $20. No purchases were made during the year. Quarterly sales information and end-of-quarter replacement cost figures follow:  The market decline in the first quarter was expected to be nontemporary. Declines in other quarters were expected to be permanent.

The market decline in the first quarter was expected to be nontemporary. Declines in other quarters were expected to be permanent.

Required:

Determine cost of goods sold for the four quarters and verify the amounts by computing cost of goods sold using the lower-of-cost-or-market method applied on an annual basis.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following is NOT required

Q3: For interim financial reporting, the effective tax

Q4: Gains and losses that arise in an

Q5: A component of an enterprise that may

Q6: An enterprise determines that it must report

Q8: The computation of a company's third quarter

Q9: Current authoritative pronouncements require the disclosure of

Q10: In SFAS No. 131, the FASB requires

Q11: If annual major repairs made in the

Q12: Which of the following statements most accurately