Essay

Imperial Corp., a U.S. corporation, entered into a contract on November 1, 2016, to sell two machines to Crown Company, for 95,000 foreign currency units (FCU). The machines were to be delivered and the amount collected on March 1, 2017.

In order to hedge its commitment, Imperial entered into a forward contract for 95,000 FCU delivery on March 1, 2017. The forward contract met all conditions for hedging an identifiable foreign currency commitment.

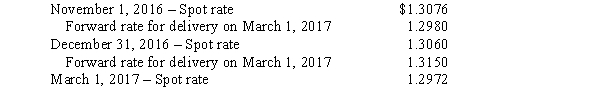

Selected exchange rates for FCU at various dates were as follows:  Required:

Required:

Prepare all journal entries relative to the above on the books of Imperial Corp. on the following dates:

1. November 1, 2016.

2. Year-end adjustments on December 31, 2016.

3. March 1, 2017. (Include all adjustments related to the forward contract.)

Correct Answer:

Verified

Correct Answer:

Verified

Q25: A discount or premium on a forward

Q26: Accounting for a foreign currency transaction involves

Q27: A transaction gain or loss is reported

Q28: On October 1, 2016, Philly Company purchased

Q29: On December 1, 2016, Dorn Corporation agreed

Q30: There are a number of business situations

Q32: A transaction gain or loss at the

Q33: With respect to disclosure requirements for fair

Q34: On October 1, 2016, Kill Company shipped

Q35: The forward exchange rate quoted for the