Essay

Consider the following information:

1. On November 1, 2017, a U.S. firm contracts to sell equipment (with an asking price of 500,000 pesos) in Mexico. The firm will take delivery and will pay for the equipment on February 1, 2018.

2. On November 1, 2017, the company enters into a forward contract to sell 500,000 pesos for $0.0948 on February 1, 2018.

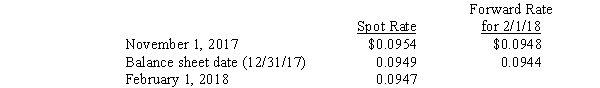

3. Spot rates and the forward rates for February 1, 2018, settlement were as follows (dollars per peso):  4. On February 1, the equipment was sold for 500,000 pesos. The cost of the equipment was $20,000.

4. On February 1, the equipment was sold for 500,000 pesos. The cost of the equipment was $20,000.

Required:

Prepare all journal entries needed on November 1, December 31, and February 1 to account for the forward contract, the firm commitment, and the transaction to sell the equipment.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: On November 1, 2017, American Company sold

Q2: Madison Paving Company purchased equipment for 350,000

Q4: On April 1, 2017, Manatee Company entered

Q5: A transaction loss would result from:<br>A) an

Q6: The discount or premium on a forward

Q7: Greco, Inc. a U.S. corporation, bought machine

Q8: From the viewpoint of a U.S. company,

Q9: A transaction gain is recorded when there

Q10: On July 15, Pinta, Inc. purchased 88,500,000

Q11: On September 1, 2017, Mudd Plating Company