Multiple Choice

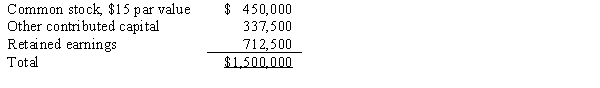

Parr Company owned 24,000 of the 30,000 outstanding common shares of Solomon Company on January 1, 2016. Parr's shares were purchased at book value when the fair values of Solomon's assets and liabilities were equal to their book values. The stockholders' equity of Solomon Company on January 1, 2016, consisted of the following:  Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2, 2016. If Parr Company purchased all 7,500 shares, the book entry to record the purchase should increase the Investment in Solomon Company account by:

Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2, 2016. If Parr Company purchased all 7,500 shares, the book entry to record the purchase should increase the Investment in Solomon Company account by:

A) $562,500.

B) $590,625.

C) $675,000.

D) $150,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: The purchase by a subsidiary of some

Q15: The computation of noncontrolling interest in net

Q16: A parent's ownership percentage in a subsidiary

Q17: Pamela Company acquired 80% of the outstanding

Q18: Poole made the following purchases of Smarte

Q20: On January 1, 2012, Pharma Company purchased

Q21: If a subsidiary issues new shares of

Q22: On January 1, 2012, Pharma Company purchased

Q23: Under the partial equity method, the workpaper

Q24: The purchase by a subsidiary of some