Essay

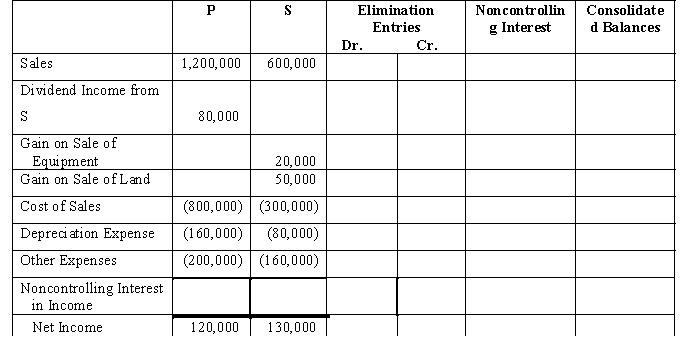

P Corporation acquired 80% of the outstanding voting stock of S Corporation when the fair values equaled the book values.

On July 1, 2016, P sold land to S for $300,000. The land originally cost P $200,000. S recently resold the land on October 30, 2017 for $350,000.

On October 1, 2017, S Corporation sold equipment to P Corporation for $80,000. S originally paid $100,000 for this equipment and had accumulated depreciation of $40,000 thus far. The equipment has a five-year remaining life.

Required:

A. Complete the consolidated income statement for P Corporation and subsidiary for the year ended December 31, 2017.

Correct Answer:

Verified

* ($20,0...

* ($20,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Company S sells equipment to its parent

Q21: P Company purchased land from its 80%

Q22: P Company bought 60% of the common

Q23: In January 2013, S Company, an 80%

Q24: In 2017, P Company sells land to

Q26: On January 1, 2017, Pharma Company purchased

Q27: Patriot Corporation owns 100% of Simon Company's

Q28: P Corporation acquired an 80% interest in

Q29: Gain or loss resulting from an intercompany

Q30: On January 1, 2016 S Corporation sold