Essay

Phillips Company purchased a 90% interest in Standards Corporation for $2,340,000 on January 1, 2016. Standards Corporation had $1,650,000 of common stock and $1,050,000 of retained earnings on that date.

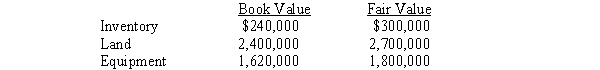

The following values were determined for Standards Corporation on the date of purchase:  Required:

Required:

A. Prepare a computation and allocation schedule for the difference between the implied and book value in the consolidated statements workpaper.

B. Prepare the January 1, 2016, workpaper entries to eliminate the investment account and allocate the difference between implied and book value.

Correct Answer:

Verified

A. Allocation of Dif...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: On January 1, 2016, Poole Company purchased

Q17: The entry to amortize the amount of

Q18: On January 1, 2016, Preston Corporation acquired

Q19: On January 1, 2016, Pamela Company purchased

Q20: Pruin Corporation acquired all of the voting

Q22: On January 1, 2016, Pamela Company purchased

Q23: Goodwill represents the excess of the implied

Q24: When the value implied by the acquisition

Q25: If the fair value of the subsidiary's

Q26: On January 1, 2016, Poole Company purchased