Essay

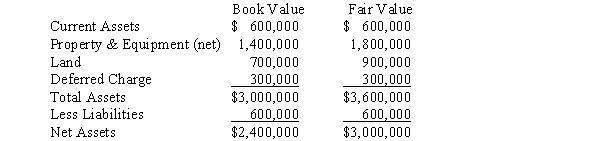

Plain Corporation acquired a 75% interest in Swampy Company on January 1, 2016, for $2,000,000. The book value and fair value of the assets and liabilities of Swampy Company on that date were as follows:  The property and equipment had a remaining life of 6 years on January 1, 2016, and the deferred charge was being amortized over a period of 5 years from that date. Common stock was $1,500,000 and retained earnings was $900,000 on January 1, 2016. Plain Company records its investment in Swampy Company using the cost method.

The property and equipment had a remaining life of 6 years on January 1, 2016, and the deferred charge was being amortized over a period of 5 years from that date. Common stock was $1,500,000 and retained earnings was $900,000 on January 1, 2016. Plain Company records its investment in Swampy Company using the cost method.

Required:

Prepare, in general journal form, the December 31, 2016, workpaper entries necessary to:

A. Eliminate the investment account.

B. Allocate and amortize the difference between implied and book value.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: If the fair value of the subsidiary's

Q26: On January 1, 2016, Poole Company purchased

Q27: On January 1, 2016, Poole Company purchased

Q28: On January 1, 2016, Pilsner Company acquired

Q29: In preparing consolidated working papers, beginning retained

Q31: The SEC requires the use of push

Q32: Pullman Corporation acquired a 90% interest in

Q33: Pennington Corporation purchased 80% of the voting

Q34: On November 30, 2016, Piani Incorporated purchased

Q35: When the value implied by the purchase