Essay

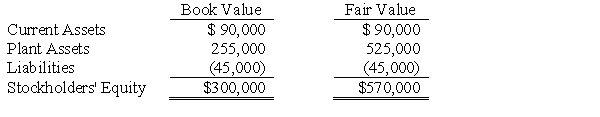

The managers of Savage Company own 10,000 of its 100,000 outstanding common shares. Swann Company is formed by the managers of Savage Company to take over Savage Company in a leveraged buyout. The managers contribute their shares in Savage Company and Swann Company then borrows $675,000 to purchase the remaining 90,000 shares of Savage Company for $600,000; the remaining $75,000 is used for working capital. Savage Company is then merged into Swann Company effective January 1, 2016. Data relevant to Savage Company immediately prior to the leveraged buyout follow:  Required:

Required:

A. Prepare journal entries on Swann Company's books to reflect the effects of the leveraged buyout.

B. Determine the balance of each of the following immediately after the merger:

1. Current Assets

2. Plant Assets

3. Note Payable

4. Common Stock

Correct Answer:

Verified

(1) $255,000 + [.90...

(1) $255,000 + [.90...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: On February 5, Pryor Corporation paid $1,600,000

Q2: Posch Company issued 12,000 shares of its

Q3: The stockholders' equities of Penn Corporation and

Q5: P Co. issued 5,000 shares of its

Q6: Briefly describe the different treatment under SFAS

Q7: Following its acquisition of the net assets

Q8: With an acquisition, direct and indirect expenses

Q9: Porpoise Corporation acquired Sims Company through an

Q10: SFAS 141R requires that the acquirer disclose

Q11: Parental Company and Sub Company were combined