Essay

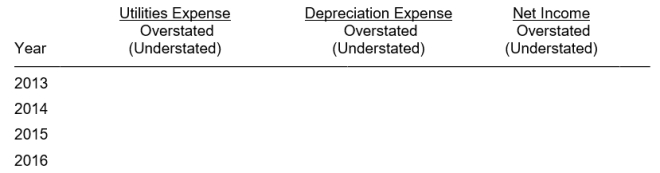

On January 1, 2012, Keller Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2013, more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Utilities Expense. Keller Company uses the straight-line method of depreciation.

Instructions

Prepare a schedule showing the effects of the error on Utilities Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2013 through the useful life of the new equipment.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: The cost of paving fencing and lighting

Q47: Equipment was acquired on January 1, 2010,

Q48: A machine costing $132,000 was destroyed when

Q51: For each entry below make a correcting

Q54: When an asset is sold, a gain

Q55: Rodgers Company purchased equipment and these costs

Q93: Which of the following statements concerning financial

Q99: Plant assets are ordinarily presented in the

Q153: Additions and improvements are costs incurred to

Q229: The IRS does not require the taxpayer