Essay

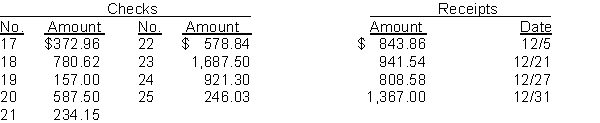

The cash balance per books for Wellmeyer Company on November 30, 2014, is $10,740.93. The following checks and receipts were recorded for the month of December 2014:  In addition, the bank statement for the month of December is presented below:

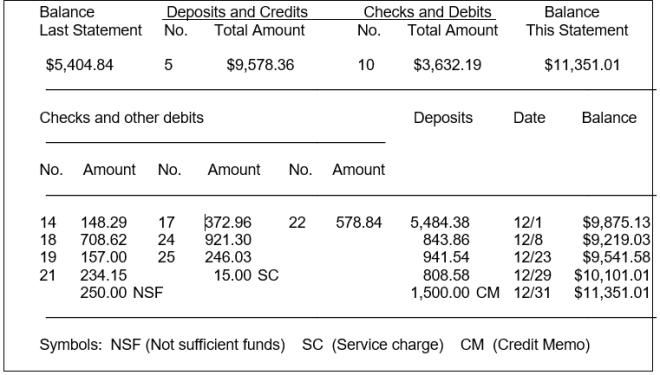

In addition, the bank statement for the month of December is presented below:  Check No. 18 was correctly written for $708.62 for a payment on account. The NSF check was from S. Gill, a customer, in settlement of an account receivable. An entry has not been made for the NSF check. The credit memo is for the collection of a note receivable including interest of $60 that has not been accrued. The bank service charge is $15.00.

Check No. 18 was correctly written for $708.62 for a payment on account. The NSF check was from S. Gill, a customer, in settlement of an account receivable. An entry has not been made for the NSF check. The credit memo is for the collection of a note receivable including interest of $60 that has not been accrued. The bank service charge is $15.00.

Instructions

(a) Prepare a bank reconciliation at December 31.

(b) Prepare the adjusting journal entries required by the bank reconciliation.

Correct Answer:

Verified

(a) Seaver Company must add th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: Two limitations of systems of internal control

Q88: In preparing a bank reconciliation outstanding checks

Q130: The Hartman Boat Company's bank statement for

Q132: A company's past experience indicates that

Q134: A petty cash fund of $200 is

Q138: Cash equivalents are defined by IFRS as<br>A)cash

Q139: The following information was taken from

Q169: An accounts payable clerk also has access

Q171: While preparing the bank reconciliation, you notice

Q180: For efficiency of operations and better control