Essay

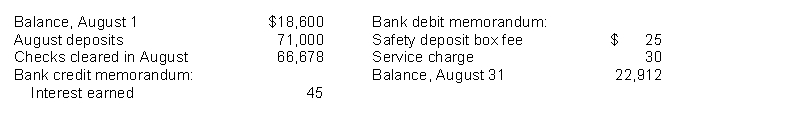

Lowe Inc.'s bank statement from Western Bank at August 31, 2014, gives the following information.  A summary of the Cash account in the ledger for August shows the following: balance, August 1, $21,100, receipts $81,000; disbursements $73,570; and balance, August 31, $28,530. Analysis reveals that the only reconciling items on the July 31 bank reconciliation were a deposit in transit for $7,000 and outstanding checks of $4,500. In addition, you determine that there was an error involving a company check drawn in August: A check for $400 to a creditor on account that cleared the bank in August was journalized and posted for $40.

A summary of the Cash account in the ledger for August shows the following: balance, August 1, $21,100, receipts $81,000; disbursements $73,570; and balance, August 31, $28,530. Analysis reveals that the only reconciling items on the July 31 bank reconciliation were a deposit in transit for $7,000 and outstanding checks of $4,500. In addition, you determine that there was an error involving a company check drawn in August: A check for $400 to a creditor on account that cleared the bank in August was journalized and posted for $40.

Instructions

(a) Determine deposits in transit.

(b) Determine outstanding checks.

(c) Prepare a bank reconciliation at August 31.

Correct Answer:

Verified

(a) Deposits in transit = $81000 - ($710...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: It is unlikely that a company would

Q61: Which of the following does not appear

Q97: The principle of internal control that prevents

Q171: At April 30, Mendoza Company has

Q173: The following information is available for Nichols

Q178: Cash equivalents include money market accounts, commercial

Q179: James Company had checks outstanding totaling $21,600

Q180: Tangible frauds include<br>A) asset misappropriation.<br>B) false pretenses.<br>C)

Q192: In preparing a bank reconciliation outstanding checks

Q193: Which of the following would be added