Multiple Choice

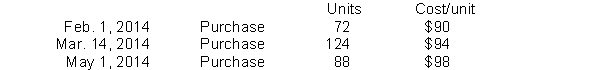

Dole Industries had the following inventory transactions occur during 2014:  The company sold 204 units at $126 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, and operating expenses of $2,000, what is the company's after-tax income using LIFO? (rounded to whole dollars)

The company sold 204 units at $126 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, and operating expenses of $2,000, what is the company's after-tax income using LIFO? (rounded to whole dollars)

A) $4,176

B) $4,323

C) $3,349

D) $2,923

Correct Answer:

Verified

Correct Answer:

Verified

Q53: Which of the following is an inventory

Q93: Which statement is <b>false</b>?<br>A)Taking a physical inventory

Q126: The lower-of-cost-or-market rule implies that it is

Q142: Which of the following should not be

Q183: Manufacturers usually classify inventory into all the

Q184: In a manufacturing company, there are three

Q187: Burnham Company reported the following summarized

Q188: Hoover Company had beginning inventory of $15,000

Q190: Faster Company uses the periodic inventory method

Q191: Which statement concerning lower of cost or