Essay

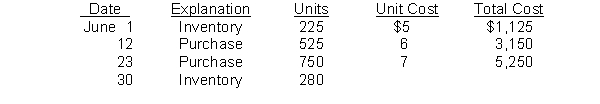

Johnson Company reports the following for the month of June.  (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average cost.

(a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average cost.

(b) Which costing method gives the highest ending inventory? The highest cost of goods sold? Why?

(c) How do the average-cost values for ending inventory and cost of goods sold relate to ending inventory and cost of goods sold for FIFO and LIFO?

Correct Answer:

Verified

(a) (1) FIFO  (2) LIFO

(2) LIFO

(b) The FIFO me...

(b) The FIFO me...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Classic Floors has the following inventory data:

Q4: Shellan Kamp Company identifies the following items

Q5: The First-in, First-out (FIFO) inventory method results

Q6: Which of the following items will increase

Q7: Hansen Company uses the periodic inventory method

Q9: Inventory written down under lower-of-cost-or market may

Q11: When the market value of inventory is

Q40: A problem with the specific identification method

Q96: Which of the following terms best describes

Q153: The LIFO inventory method agrees with the