Essay

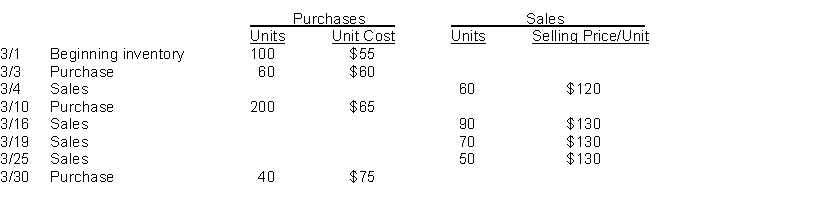

Grayson Company sells many products. Gizmo is one of its popular items. Below is an analysis of the inventory purchases and sales of Gizmo for the month of March. Grayson Company uses the perpetual inventory system.  Instructions

Instructions

(a) Using the FIFO assumption, calculate the amount charged to cost of goods sold for March. (Show computations)

(b) Using the FIFO assumption, calculate the value of ending inventory for March.

(c) Using the moving average cost method, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(d) Using the LIFO assumption, calculate the amount assigned to the inventory on hand on March 31. (Show computations)

(e) Using the LIFO assumption, calculate the amount charged to cost of goods sold for March. (Show computations)

Correct Answer:

Verified

(a) Using FIFO - the earliest...

(a) Using FIFO - the earliest...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: When is a physical inventory usually taken?<br>A)When

Q75: Under the LCM basis, market is defined

Q76: At May 1, 2014, Heineken Company had

Q77: Under the LCM basis, market is defined

Q79: Specific Identification must be used for inventory

Q81: Use of the LIFO inventory valuation method

Q81: Barnett Company had the following records: <img

Q83: The Cain Company has just completed a

Q155: In a perpetual inventory system,<br>A)LIFO cost of

Q155: Which of the following is not a