Essay

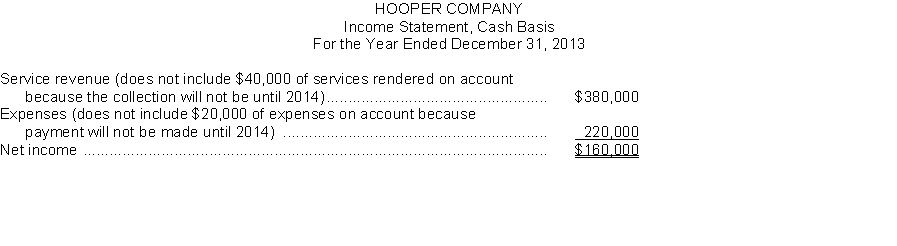

Hooper Company prepared the following income statement using the cash basis of accounting:  Additional data:

Additional data:

1. Depreciation on a company automobile for the year amounted to $7,000. This amount is not included in the expenses above.

2. On January 1, 2013, paid for a two-year insurance policy on the automobile amounting to $1,600. This amount is included in the expenses above.

Instructions:

(a) Recast the above income statement on the accrual basis in conformity with generally accepted accounting principles. Show computations and explain each change.

(b) Explain which basis (cash or accrual) provides a better measure of income.

Correct Answer:

Verified

(a)  Service revenue should include the ...

Service revenue should include the ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The adjusting entry for unearned revenue results

Q23: Walton Company collected $9,600 in May of

Q25: The adjusted trial balance of Nicks Financial

Q28: The Accounts Receivable account has a beginning

Q29: The trial balance for Greenway Corporation appears

Q30: Masterfalls Corporation purchased a one-year insurance policy

Q112: The expense recognition principle matches<br>A) customers with

Q144: A furniture factory's employees work overtime to

Q189: The difference between the cost of a

Q198: The revenue recognition principle dictates that revenue