Essay

The Downtown Company accumulates the following adjustment data at December 31.

1. Revenue of $1,100 collected in advance has been recognized.

2. Salaries of $600 are unpaid.

3. Prepaid rent totaling $400 has expired.

4. Supplies of $550 have been used.

5. Revenue recognized but unbilled totals $750.

6. Utility expenses of $300 are unpaid.

7. Interest of $250 has accrued on a note payable.

Instructions:

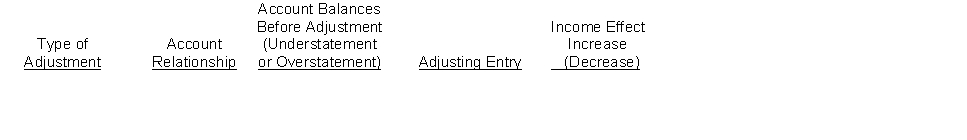

(a) For each of the above items indicate:

1. The type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accrued expense).

2. The account relationship (asset/liability, liability/revenue, etc.).

3. The status of account balances before adjustment (understatement or overstatement).

4. The adjusting entry.

(b) Assume net income before the adjustments listed above was $22,500. What is the adjusted net income?

Prepare your answer in the tabular form presented below.

Correct Answer:

Verified

Correct Answer:

Verified

Q130: An adjusting entry can include a:<br>A)debit to

Q138: The Dividends account is closed to the

Q154: An adjusting entry can include a:<br>A)debit to

Q189: Wang Company had the following transactions during

Q192: At March 1, 2014, Candy Inc. had

Q194: River Ridge Music School borrowed $30,000 from

Q195: After all closing entries are journalized and

Q197: Identify the impact on the balance sheet

Q198: Adjusting entries are needed to enable financial

Q235: Under the cash basis of accounting:<br>A)revenue is