Essay

A review of the ledger of Wilde Co. at December 31, 2014, produces the following data pertaining to the preparation of annual adjusting entries:

(a) Salaries and Wages Payable $0: Salaries are paid every Friday for the current week. Five employees receive a weekly salary of $800, and three employees earn a weekly salary of $700. December 31 is a Tuesday. Employees do not work weekends. All employees worked the last 2 days of December.

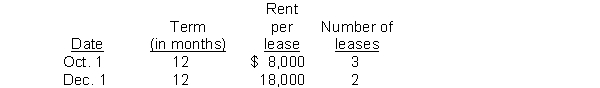

(b) Unearned Rent Revenue $58,000: The company had several lease contracts during the year as shown below:  (c) Notes Receivable $90,000: This is a 6-month note, dated November 1, 2014, with a 6% interest rate.

(c) Notes Receivable $90,000: This is a 6-month note, dated November 1, 2014, with a 6% interest rate.

Instructions:

Prepare the adjusting entries at December 31, 2014. Show all computations.

Correct Answer:

Verified

Correct Answer:

Verified

Q101: A liability-revenue account relationship exists with an

Q124: Payments of expenses that will benefit more

Q164: A liability-revenue relationship exists with:<br>A)asset accounts.<br>B)revenue accounts.<br>C)unearned

Q204: The following accounts show balances on the

Q204: Income will always be greater under the

Q235: If a business has received cash in

Q275: An adjusting entry recording accrued salaries for

Q278: The following is selected information from L

Q279: The trial balance for Greenway Corporation appears

Q280: James & Younger Corporation purchased a one-year