Essay

A review of the ledger of Weakly Service Co. at December 31, 2014, produces the following data pertaining to the preparation of annual adjusting entries:

(a) Notes Payable $80,000: This is a 9-month note, dated September 1, 2014, with a 9% interest rate.

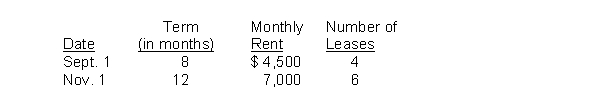

(b) Prepaid Rent $648,000. The company rents offices throughout the Midwest. During 2014 it signed 10 leases as shown below:  (c) Unearned Service Revenue $171,000. During 2014 the company entered into 13 monthly service contracts with clients. The clients prepaid for the services to be provided over the contract period in an even manner.

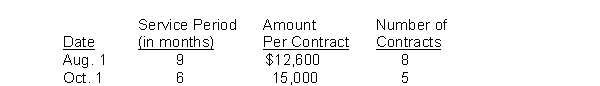

(c) Unearned Service Revenue $171,000. During 2014 the company entered into 13 monthly service contracts with clients. The clients prepaid for the services to be provided over the contract period in an even manner.  Instructions:

Instructions:

Prepare the adjusting entries at December 31, 2014. Show all computations.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Wang Company had the following transactions during

Q19: Presented below is the Trial Balance and

Q21: Bluing Corporation issued a one-year 9% $300,000

Q23: Walton Company collected $9,600 in May of

Q25: The adjusted trial balance of Nicks Financial

Q163: Closing entries result in the transfer of

Q164: A revenue account is closed with a

Q189: The difference between the cost of a

Q198: The revenue recognition principle dictates that revenue

Q254: An adjusting entry made to record accrued