Multiple Choice

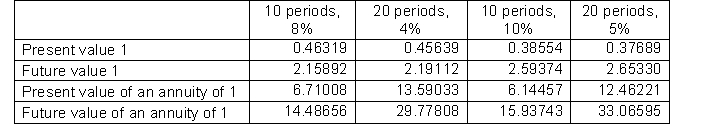

Patterson Company is about to issue $8,000,000 of 10-year bonds paying an 8% interest rate with interest payable semiannually. The discount rate for such securities is 10%. Below are time value of money factors that Patterson uses to calculate compounded interest.  To the closest dollar, how much can Patterson expect to receive for the sale of these bonds?

To the closest dollar, how much can Patterson expect to receive for the sale of these bonds?

A) $7,003,027

B) $5,852,740

C) $16,000,000

D) $28,110,060

Correct Answer:

Verified

Correct Answer:

Verified

Q28: An unrealized gain or loss on available-for-sale

Q68: Short-term investments are securities that are readily

Q139: The cost method of accounting for investments

Q141: Using the cost method of accounting for

Q146: Grafton Company had the following transactions pertaining

Q165: The Fair Value Adjustment account is a

Q172: The following transactions were made by Aquavore

Q310: On January 1, 2014, Chic Corp. paid

Q311: To compute the present value of a

Q312: In computing the present value of an