Multiple Choice

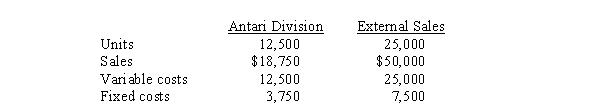

The Jupiter Division of Space, Inc. produces dilithium crystals. One-third of its output is sold to the Antari Division, and the remainder is sold externally. Jupiter's estimated sales and cost data for the coming year are:  Assume that Jupiter cannot sell any additional crystals externally. If the Antari Division has an opportunity to buy from an outside supplier at $1.40 per crystal and Jupiter refuses to meet this price, the company as a whole will be

Assume that Jupiter cannot sell any additional crystals externally. If the Antari Division has an opportunity to buy from an outside supplier at $1.40 per crystal and Jupiter refuses to meet this price, the company as a whole will be

A) $1,250 better off

B) $3,750 worse off

C) $6,250 better off

D) $5,000 worse off

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Economic value added can be measured so

Q16: Executive compensation is typically set by the

Q40: Transfer pricing policies can affect a company's

Q58: Which of the following best describes "general

Q61: If a supplying division has excess capacity,

Q73: Division A of a firm produces a

Q96: If manufacturing departments are only responsible for

Q97: Use the following information for the next

Q99: Use the following information for the next

Q104: When decision making is decentralized<br>A) Upper management