Multiple Choice

Use the following information for the next 2 questions.

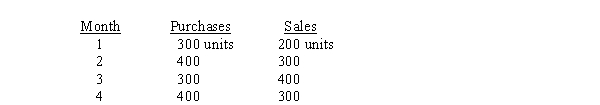

Bynsel, Inc., a retailer, projects the following purchases and sales of its product for the next 4 months:  Each unit costs $100, and all purchases are on account. Two-thirds of purchases are paid in the month of the purchase and one-third are paid in the month following the purchase. Bynsel gets a 3% discount whenever it pays in the month of the purchase. The selling price per unit is $200. Sales are 60% cash and 40% on customer credit cards. The bank charges Bynsel a 5% fee for each credit card transaction and transfers the funds to Bynsel's checking account on the same day as the credit card sale.

Each unit costs $100, and all purchases are on account. Two-thirds of purchases are paid in the month of the purchase and one-third are paid in the month following the purchase. Bynsel gets a 3% discount whenever it pays in the month of the purchase. The selling price per unit is $200. Sales are 60% cash and 40% on customer credit cards. The bank charges Bynsel a 5% fee for each credit card transaction and transfers the funds to Bynsel's checking account on the same day as the credit card sale.

-What are cash disbursements for the third month?

A) $36,367

B) $23,033

C) $33,333

D) $32,733

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Differences between budgeted amounts and actual amounts

Q60: An advantage of a flexible budget is

Q73: The primary disadvantage of zero-based budgeting is:<br>A)

Q92: In an activity-based budgeting system, managers develop

Q108: Use the following information for the next

Q110: Which of the following items is least

Q111: Use the following information for the next

Q113: Use the following information for the next

Q114: Use the following information for the next

Q115: TFS' actual income for the next fiscal