Essay

On January 1, 2021 Taffy Inc. granted 210,000 stock appreciation rights (SARs)to its executives. Each SAR entitled its holder to receive cash equal to the difference between the market price of the common share and the benchmark price of $16. The SARs vested after three years and expired on Dec. 31, 2023. On January 1, 2024, 100,000 SARs are exercised. The market price of the shares remained at $20. On January 1, 2025, 50,000 SARS are exercised. The market price of the shares remained at $22. The remaining SARs expired.

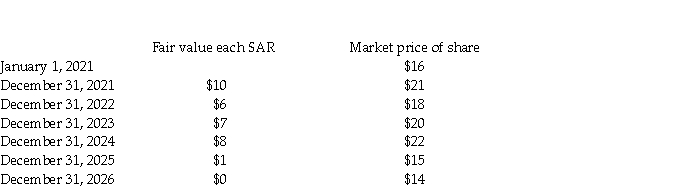

Pertinent stock-related data are listed below:  Required:

Required:

a. Prepare the journal entry at December 31, 2021, to record compensation expense.

b. Prepare the journal entry at December 31, 2022, to record compensation expense.

c. Prepare the journal entry at December 31, 2023, to record compensation expense.

d. Prepare the journal entry at January 1, 2024, to record the partial exercise of the SARs.

e. Prepare the journal entry at December 31, 2024, to record compensation expense.

f. Prepare the journal entry at January 1, 2025, to record the partial exercise of the SARs.

g. Prepare the journal entry at December 31, 2025, to record compensation expense.

h. Prepare the journal entry at December 31, 2026, to record compensation expense.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Contrast options with warrants.

Q10: Enterprises need to separate the components of

Q11: Give 4 examples of cash flow hedges:

Q12: Breezy Lodge issued 25,000 at-the-money stock options

Q13: Which of the following is an example

Q16: Which of the following is correct regarding

Q18: A company had a debt-to-equity ratio of

Q19: How would exercise of warrants that were

Q46: Which method is used under ASPE to

Q70: How is the subsequent conversion of bonds