Essay

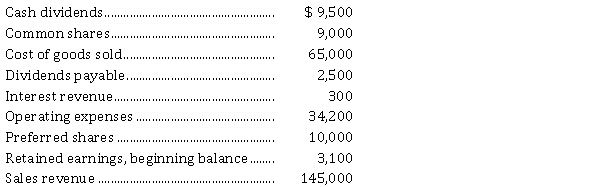

The following information is taken from the trial balance of GlaxonSmith Supplies Ltd. at December 31, 2021, the company's year end. GlaxonSmith has a 25% tax rate. One of the entries making up the balance of retained earnings is an adjustment that was required due to the overstatement of prior year's depreciation expense by $ 1,600 which is net of tax effect.  Instructions

Instructions

Prepare the income statement and statement of retained earnings for GlaxonSmith for the year ended December 31, 2021 using the multiple-step format for the income statement.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: On January 1, 2021, Only You Merchandise

Q27: On January 1, 2021, Grieve Grocers Inc.'s

Q28: On January 1, 2020, Accounting For You

Q29: Cheers Corporation reported the following information related

Q30: Westcock Shipbuilding Ltd. has a December 31

Q32: At January 1, 2021, Stevenson Inc. had

Q33: Harvey Hovercraft Inc. reported the following shareholders'

Q34: On January 1, 2021, Chu Corporation had

Q35: Moe Money

Q36: Saha Company had profit of $ 1,020,000