Essay

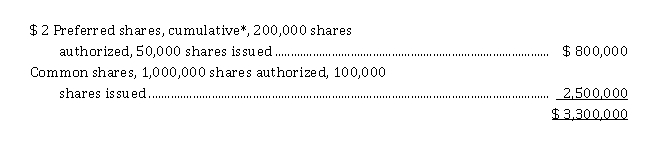

At July 1, 2020, Peters Corporation had the following share capital:  *The preferred dividends are 2 years in arrears.

*The preferred dividends are 2 years in arrears.

On January 1, 2021, the board of directors declared and paid a 15% common stock dividend when the market price of common shares was $ 23.50. On April 1, 2021, the company sold an additional 1,000,000 common shares for proceeds of $ 5,680,000. The corporation earned $ 722,000 during the year and paid $ 186,000 in dividends.

Instructions

a). Calculate Peters Corporation's earnings per share for the year ended June 30, 2021, assuming the company paid $ 186,000 in cash dividends.

b) Calculate Peters Corporation's earnings per share for the year ended June 30, 2021, assuming the company paid $ 186,000 in cash dividends but there were no preferred dividends in arrears.

c) Calculate Peters Corporation's earnings per share for the year ended June 30, 2021, assuming the preferred dividends are noncumulative and $ 50,000 in total cash dividends were paid during the year.

Correct Answer:

Verified

a) ($ 722,000 - $ 100,000) ÷ 357,5001 = $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: At January 1, 2021, Stevenson Inc. had

Q33: Harvey Hovercraft Inc. reported the following shareholders'

Q34: On January 1, 2021, Chu Corporation had

Q35: Moe Money

Q36: Saha Company had profit of $ 1,020,000

Q37: 12345678 Ontario Ltd. which has authorized share

Q38: Brown Nose Corporation's shareholders' equity section at

Q40: Strict Fitness Ltd. has a December 31

Q41: Moreland Holdings Inc. has authorized share capital

Q42: Jenny OTB Corporation reports the following shareholders'