Essay

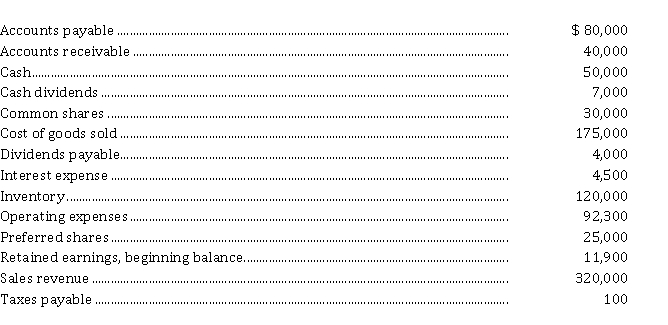

The trial balance of Terris Inc. for the year ended September 30, 2021, prior to recording of tax expenses, but after all other adjustments, is as follows. All accounts are their normal balance (debit or credit). Terris has a tax rate of 30%.  Instructions

Instructions

Prepare the income statement and statement of retained earnings for Terris Inc. for the year ended September 30, 2021.

Correct Answer:

Verified

Correct Answer:

Verified

Q49: Accounting entries are required for dividends on

Q55: Norton Corporation has the following shareholders equity

Q57: Which of the following is NOT a

Q58: The following information is available for Mobily

Q59: Journal entries are made on the date

Q66: The articles of incorporation can contain all

Q95: The statement of retained earnings<br>A) is required

Q123: The two ways that a corporation can

Q163: The dominant form of business organization in

Q176: Organization costs are normally capitalized by public