Essay

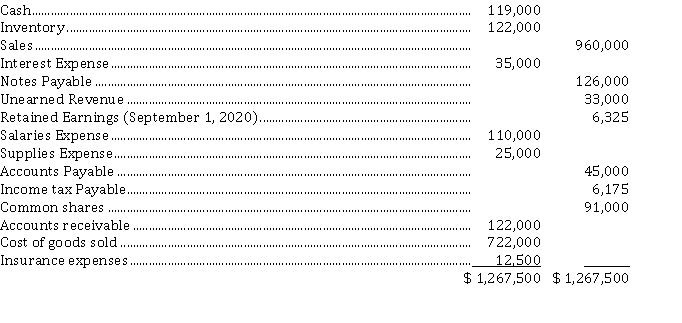

Maki and Leduc Inc. has recorded all necessary adjusting entries, except for income tax expense, at its fiscal year end August 31, 2021. The following information has been taken from the adjusted trial balance:  Maki and Leduc Inc. has a 15% tax rate.

Maki and Leduc Inc. has a 15% tax rate.

Instructions

a) Prepare a multi-step income statement and the required journal entry to adjust income tax expense.

b) Prepare a statement of retained earnings.

c) Prepare closing entries.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Canadian Tire Corporation is an example of

Q80: Which of the following is NOT generally

Q87: Companies must have enough cash before they

Q91: In cases where the fair value of

Q94: The statement that reflects the changes in

Q128: The authorized shares of a corporation<br>A) only

Q129: Sandex Corporation's balance sheet reported the following

Q133: Match the items below by entering the

Q134: The Star Wars Industries has the following

Q135: Retained earnings are<br>A) always equal to the