Essay

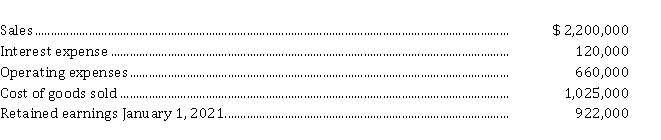

Jogger Inc. is a private corporation reporting under ASPE. At December 31, 2021, its adjusted trial balance contained the following summary data:  Additional information:

Additional information:

1. In 2021 dividends of $ 30,000 were declared on March 31, June 30, September 30 and December 31 respectively. The dividends were paid on April 9, 2021, July 10, 2021, October 4, 2021 and January 12, 2022 respectively.

2. The company's tax rate is 25%.

Instructions

a) Determine the income tax expense and prepare a multi-step income statement for 2021.

b) Prepare a statement of retained earnings for 2021.

Correct Answer:

Verified

a) Income tax expense

($ 2,200...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

($ 2,200...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: Preferred shares issued with the right of

Q125: Shareholders of a corporation directly elect<br>A) the

Q153: Which of the following is NOT true

Q155: Dividends in arrears on cumulative preferred shares<br>A)

Q177: Heinfell Inc. reported sales of $ 850,000,

Q179: A public corporation is a corporation that

Q180: Kean's Pumping, Inc. has 20,000, $ 4,

Q181: Cash dividends are shown as an addition

Q182: ABC Industries has the following account balances:

Q186: In its first year of operations, Snake