Multiple Choice

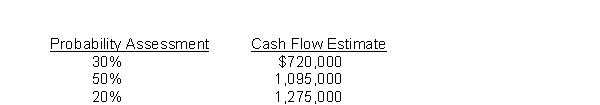

Reegan Company owns a trade name that was purchased in an acquisition of Hamilton Company.The trade name has a book value of $5,250,000, but according to GAAP, it is assessed for impairment on an annual basis.To perform this impairment test, Reegan must estimate the fair value of the trade name.It has developed the following cash flow estimates related to the trade name based on internal information.Each cash flow estimate reflects Reegan's estimate of annual cash flows over the next 7 years.The trade name is assumed to have no residual value after the 7 years.(Assume the cash flows occur at the end of each year.)  Reegan determines that the appropriate discount rate for this estimation is 6%.To the nearest dollar, what is the estimated fair value of the trade name?

Reegan determines that the appropriate discount rate for this estimation is 6%.To the nearest dollar, what is the estimated fair value of the trade name?

A) $5,250,000

B) $1,018,500

C) $3,090,000

D) $5,685,654

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If $4,000 is put in a savings

Q6: On January 1, 2015, Ball Co.exchanged equipment

Q7: On December 30, 2015, AGH, Inc.purchased a

Q8: In the time diagram below, which concept

Q10: Lane Co.has a machine that cost $600,000.It

Q19: Which of the following is true?<br>A) Rents

Q22: If a savings account pays interest at

Q57: Simple interest is computed on principal and

Q58: Jeremy Leasing purchases and then leases small

Q100: Assume ABC Company deposits €50,000 with First