Essay

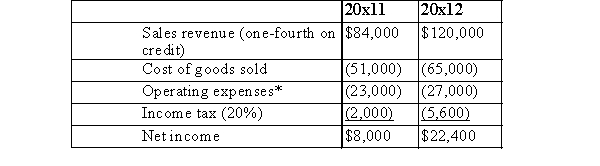

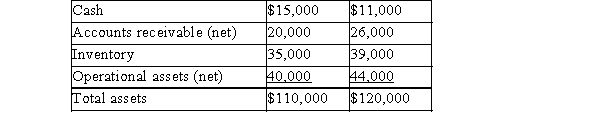

The following data was reported by JSB for a two-year period:  Assets:

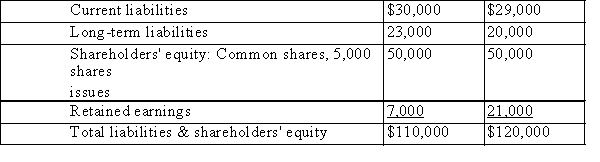

Assets:  Liabilities:

Liabilities:  *Includes interest expense, $2,500 (pre-tax)

*Includes interest expense, $2,500 (pre-tax)

(a)Compute the following ratios for 20x12:

(1)Receivable turnover

(2)Inventory turnover

(3)Creditors' equity to total assets

(4)Acid test ratio

(5)Return on owners' equity

(6)Profit margin on sales

(7)Current ratio

(8)Return on total assets

(9)Owners' equity to total assets

(10)Financial leverage

(b)Briefly explain and interpret financial leverage.

Correct Answer:

Verified

(a)  (b)The measure of financial leverag...

(b)The measure of financial leverag...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Return on total assets is generally considered

Q17: The decision to capitalize (as opposed to

Q18: Upon reading the notes to the financial

Q19: Vertical analysis of financial statements refers to

Q20: A company which offers "n/30" credit terms

Q22: A primary reason for the analysis of

Q23: A company's return on investment is affected

Q24: To apply a vertical analysis to the

Q25: What do solvency ratios measure?

Q26: All of the following are examples of