Multiple Choice

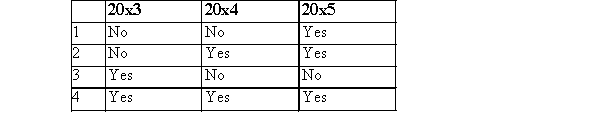

Compensatory stock options were granted to executives on January 1, 20x3, with a measurement date of June 30, 20x4, for services to be rendered during 20x3, 20x4, and 20x5.The excess of the market value of the shares over the option price at the measurement date was reasonably estimable at the date of grant.The stock option was exercised on October 31, 20x5.Compensation expense should be recognized in the income statement in which of the following years?

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Correct Answer:

Verified

Q83: Convertible debt that is convertible to a

Q84: Convertible bonds with a floating conversion price

Q85: The incremental method to accounting for convertible

Q86: On April 1, Year 1, ABC Inc.,

Q87: Once the market price of shares rises

Q89: When convertible bonds are submitted for conversion,

Q90: Retractable preferred shares are those which can

Q91: Which of the following forms part of

Q92: Rights granted to existing shareholders entitling them

Q93: KIM Corp.owned a major business building in