Essay

ABC Inc.borrowed funds from its bank.Details are as follows.

Four year term loan, U.S.$500,000

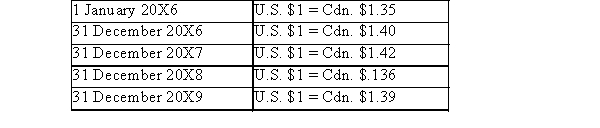

Funds borrowed 1 January 20X6; due 31 December 20X9 Exchange rates:  Part A: Based on the above information prepare entries to record receipt of loan proceeds for January 20X6.

Part A: Based on the above information prepare entries to record receipt of loan proceeds for January 20X6.

Part B: Based on the above information prepare entries to record the adjustment to spot rate for December 20X6.

Part C: Based on the above information prepare entries to record adjustment to spot rate December

20X7

Part D: Based on the above information prepare entries to record adjustment to spot rate December 20X8

Part E: Based on the above information prepare entries to record adjustment to spot rate December 20X9

Part F: Based on the above information prepare entries to record repayment of loan December 20X9 Part G: Based on the above information calculate the total accounting recognition of loss.

Correct Answer:

Verified

Part A:  Part B:

Part B:  Pa...

Pa...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: AB sold its 10-year bond at a

Q63: AB owes a $100,000, 8%, five-year note

Q64: A firm retired a long-term note by

Q65: Hedging is one method of minimizing foreign

Q66: On September 1, 2015, a company signed

Q68: JMR bought 15 Z Corporation's $1,000 bonds

Q69: Which of the following is not one

Q70: The capitalization of borrowing costs is mandatory

Q71: Bonds payable should be reported as a

Q72: Gains or losses from the early extinguishment