Essay

A company wishes to finance a long-term construction project and in doing so, capitalize the related interest expense.The company requires $2 million in financing.

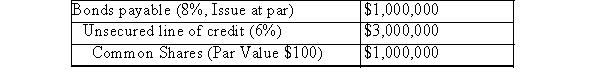

The company currently has the following debt and equity items on its December 31st, 2019 Balance Sheet:  There are 10,000 common shares outstanding which pay an annual dividend of $5 per share.The company can borrow a maximum of $5 million on its unsecured line of credit.

There are 10,000 common shares outstanding which pay an annual dividend of $5 per share.The company can borrow a maximum of $5 million on its unsecured line of credit.

The company's bank has indicated its willingness to extend an additional credit facility in the amount of $1.5 million at an annual rate of 5% as of March 31st, Year 6.These amounts remained outstanding throughout Year 6.

On March 1st, Year 6 the company borrowed $600,000.On April 1st, Year 6, and additional $1.4 million was wired to the company's account, drawn on its new credit facility.

Determine the amount of interest that the company would be able to capitalize as per IFRS for Year

Correct Answer:

Verified

The company requires $2 Million.$500,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Assume that a company issues bonds at

Q3: In-substance defeasance leads to the de-recognition of

Q4: When the interest payment dates of a

Q5: When the interest payment dates of a

Q6: The rate of interest used to discount

Q8: Bonds payable (due 5 years from the

Q9: On January 1, 1999, a company incurred

Q10: A firm has two bonds outstanding today,

Q11: If a bond was sold at $108,

Q12: In theory (disregarding any other marketplace variables)the