Essay

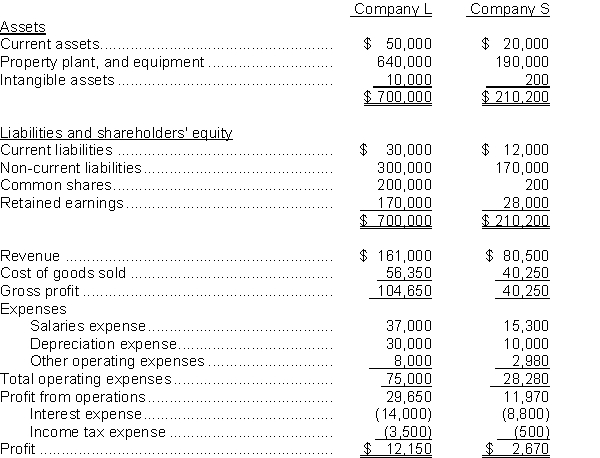

The balance sheets and income statements for two competing companies in the same industry are presented below:  Instructions

Instructions

a. Calculate both companies' Debt to Total Assets ratio.

b. Calculate both companies' Interest Coverage ratio.

c. Comment on the two companies' solvency in comparison to each other.

d. One of the companies is a public company, and the other is a private company. Identify which of the two companies appears to be the public company and explain your conclusion. Describe how that affects the extent to which it is financed by debt in comparison to the other company.

Correct Answer:

Verified

a. Company L ($30,000 + $300,000) ÷ $700...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Solvency ratios are used to measure a

Q23: Earnings per share is calculated<br>A) only for

Q24: Investors who are interested in purchasing a

Q25: Which of the following is NOT commonly

Q26: Investors who are interested in purchasing company

Q28: The asset turnover ratio measures<br>A) how often

Q29: Which one of the following ratios would

Q30: Current Ratio is total assets divided by

Q31: In analyzing the financial statements of a

Q32: Use the following information for questions